34+ two names on deed one on mortgage

Web You could apply to your lender to be the only borrower on the new mortgage loan but because your ex-wife is still on the deed the lender will require that she sign the mortgage document itself as well as a couple of the other closing documents as a non-borrower owner. Taking out a mortgage under one persons name or putting only one spouses name on the title deed.

Two Names On Deed One Person Dies What Then Supermoney

2 names on mortgage one on deeds as otherwise she would be putting him on the deeds of a house that is not fully hers as in the bank has a mortgage over it.

. Better credit score and the other person doesnt that person should keep in mind if they want ownership they have to sign the title. Web It is a good idea to have both names on the title before you close. If two people are listed on the deed as joint owners each owns an undivided one-half interest in the whole of the property.

Joint tenancy means that each person named on the deed has equal ownership to the property. If your name is on the deed but not the mortgage it means that you are an owner of the home but are not liable for the mortgage loan and the resulting payments. Remember the name on the mortgage is the person who is responsible for ensuring the payments on the loan.

Request any relevant information from the mortgage company. There are generally three types of joint ownership in New York. Web You can have two names on title with one on mortgage but there are some risks.

Web If two people are buying a home together and one person signs the mortgage Ex. You will need to clarify this statement before a lawyer can advise you because it is unclear who actually owns the property. The two terms deed and title are often used synonymously.

In most states a married couple can apply for mortgages pay for a house and title a house under the name of just one spouse. For those mortgage programs that permit non-occupant borrowers this lender preference is typically waived. It is generally okay to have two names on title and one on the mortgage.

A will protects your ownership. Web If a Deed Names Two Persons but Only One is Named on the Mortgage How is the Property Treated in Separation. Web When two names are on a deed and one person dies the first thing a lawyer would scrutinize is the language of the deed.

Being mindful of all documents you sign during the home buying process is very important. Web Theres no legal limit as to how many names can be on a single home loan but getting a bank or mortgage lender to accept a loan with multiple borrowers might be challenging. Web Legally at least one borrower must be on the title deed to qualify for a mortgage loan.

Not sure of tax position but imagine he is seen as giving her a gift of his deposit money and gift tax payable. Ownership of real estate is evidenced by a deed. Web Normally only works other way around ie.

The house deed is the physical document that is used to transfer title and thus proves who owns the house. Not all lenders will be willing to amend the title to add a name while some might be lenient if it is a family member. They may not agree as at the moment they have two people to chase in case of arrears and afterwards will only have one.

An example of how this reads is John Doe and Jane Doe as Husband and Wife. Web Claiming Deductions as a Joint Tenant. That doesnt square with you wanting to put your name on the deeds.

Web Buying a house under one name can refer to two different things. Web If youre not party to the mortgage but intend to live there together as your home then as part of the mortgage offer many lenders will require you to sign a waiver basically declaring you have no interest in the property. Learn the ownership implications of your name being on the deed of a home verses the financial responsibility of your name showing up on the mortgage.

However most mortgage lenders prefer that all borrowers appear on the title. Web Call your mortgage company and let the representative know that youll be using a deed to change the title into your new name. Joint tenancy with rights of survivorship tenancy in.

This is important to do as soon as possible and its best done before you change your name. If your sister refuses to cooperate then you may have no choice but to file a partition lawsuit. Sole Owner If a recorded deed contains only one name that person is the legal owner and has full legal power to sell or will away the house or other real property even if someone else has contributed to its purchase and holds a nonrecorded interest.

Web One Persons Name. In New York State when a husband and wife buy a house together and the Deed states that they are husband and wife the law affords them certain protections. In most states separately-filing joint tenants can claim the.

Web Yes someone can be on the title and not the mortgage. Web In order to simply transfer the title of the property from joint owners to sole owner you would need the permission of the lender. Web Often times when a husband and wife or any two people buy a house together they take ownership together.

Web Revenues guidelines gave a specific example where the FTB exemption can still apply to 2 names on mortgageone on deeds where specific conditions are met eg. Web You say that you are both on the deed but that it is not recorded. Not having your name on the mortgage doesnt absolve you from paying if the other person stops.

A person whose name is on a house deed has the title to that particular house. Homeowners names can appear on the title and not on the mortgage. Among others the second name on the mortgage is a parentother benefactors name put there at the request of the bank as a step up from being a mere guarantor.

The lender could come after you for the money before letting the home go into foreclosure. Web What Happens if Your Name is on the Deed but not the Mortgage. Web The title or deed of a home is separate from the mortgage or loan.

1869 Penfield Walworth Road Walworth Ny 14568 Mls R1407646 Howard Hanna

Eu Council Manual Law Enforcement Information Exchange 7779 15

Loan Sun Pacific Mortgage Real Estate Hard Money Loans In California

How To Find The Owner Of A Property Who Owns This House

How To Buy A House Before Selling Your Current House

How To Add A Spouse To A Deed 9 Steps With Pictures Wikihow

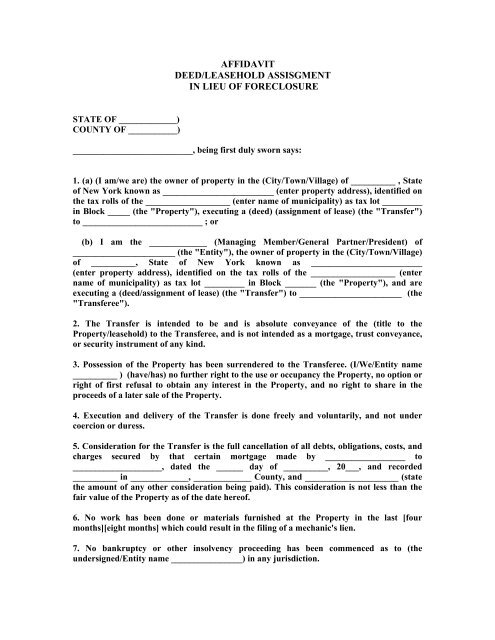

Affidavit For Deed In Lieu Of Foreclosure First American Title

Here Is Why You Should Not Have Two Names On The Mortgage

What Fixes Are Mandatory After A Home Inspection

Loud Logos 34 Best Loud Logo Ideas Free Loud Logo Maker 99designs

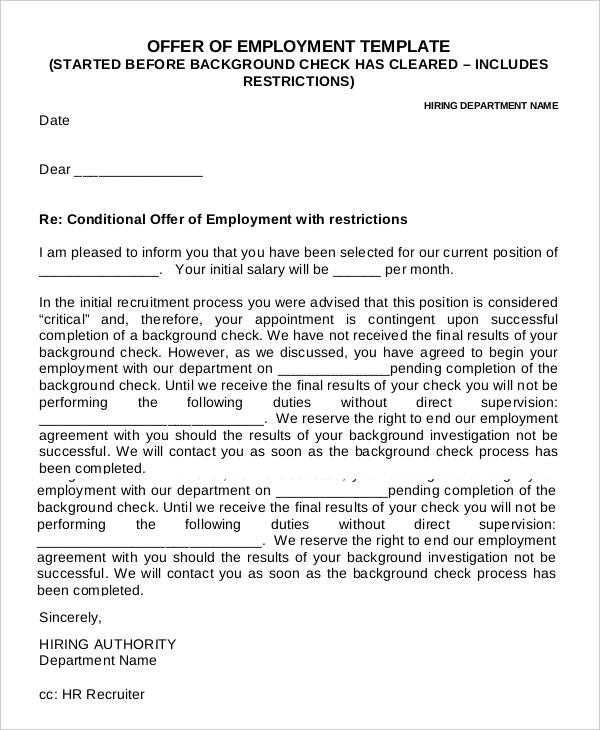

34 Offer Letter Examples Free Word Pdf Documents Download

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Powhatan Today 05 05 2021 By Powhatan Today Issuu

Free 34 Loan Agreement Forms In Pdf Ms Word

Transferring A Property Into Joint Names

34 Printable Agreement Templates Word Pdf Pages

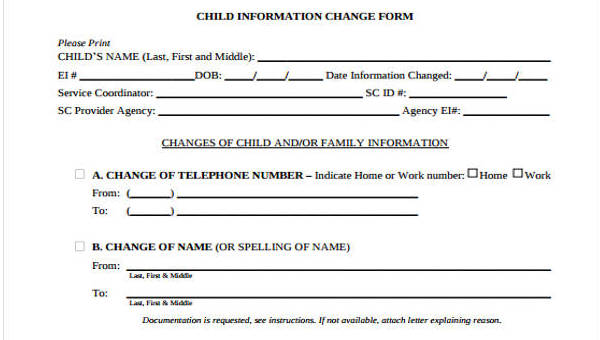

Free 34 Change Form Templates In Pdf Ms Word Excel