Pension lump sum calculator

Some pensions allow the owner to either take a large lump sum at the beginning of the retirement or receive equal annual payments. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement.

Exxonmobil Lump Sums Fall As Rates Are On The Rise

Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

. Receiving a lump sum. And The Right Choice May Not Be Obvious. Use this pension calculator to help decide which pension option works best for particular retirement needs.

This lump sum savings calculator will help you precisely calculate the amount of interest youll receive by. The Pension Calculator is powered by our partner Profile Pensions. The calculator provides estimated results and is not intended to.

The pension calculator will run through your figures and return a full breakdown of your pension annuity and produce charts and a statement of every payment. Lump sum calculator 25 Overview When you take your pension you will be able to give up some of it for lump sum up to a certain limit. In fact up to 25 of the value of your pension can be taken tax-free and our handy calculator will help you to estimate the balance between lump sum and annual.

In the context of pensions the former is sometimes. Tax on lump sums at retirement. The 30-Year Treasury rate has been rising this year but is still lower than the historical average of 479.

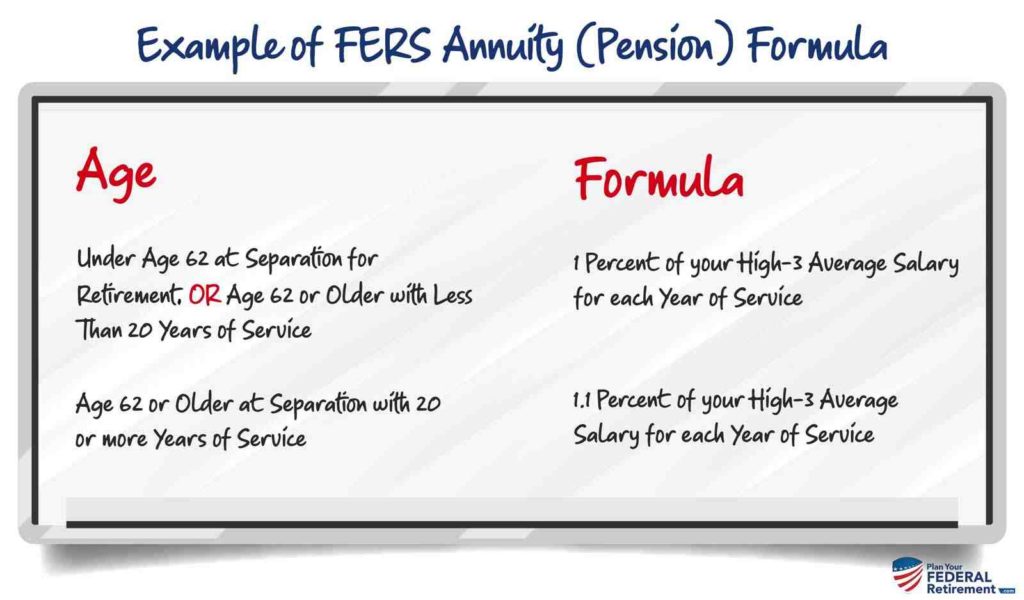

Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Find out what the required annual rate of return required would be for.

I can only estimate because plans vary in how quickly they adopt. Retirees Often Face a Tough Decision. Currently a maximum of 200000 can be taken as a tax free pension lump sum.

This calculator will help you figure out how much income tax youll pay on a lump. It can be used for illustrative purposes and can give you an estimate of what you might be able to expect in retirement. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

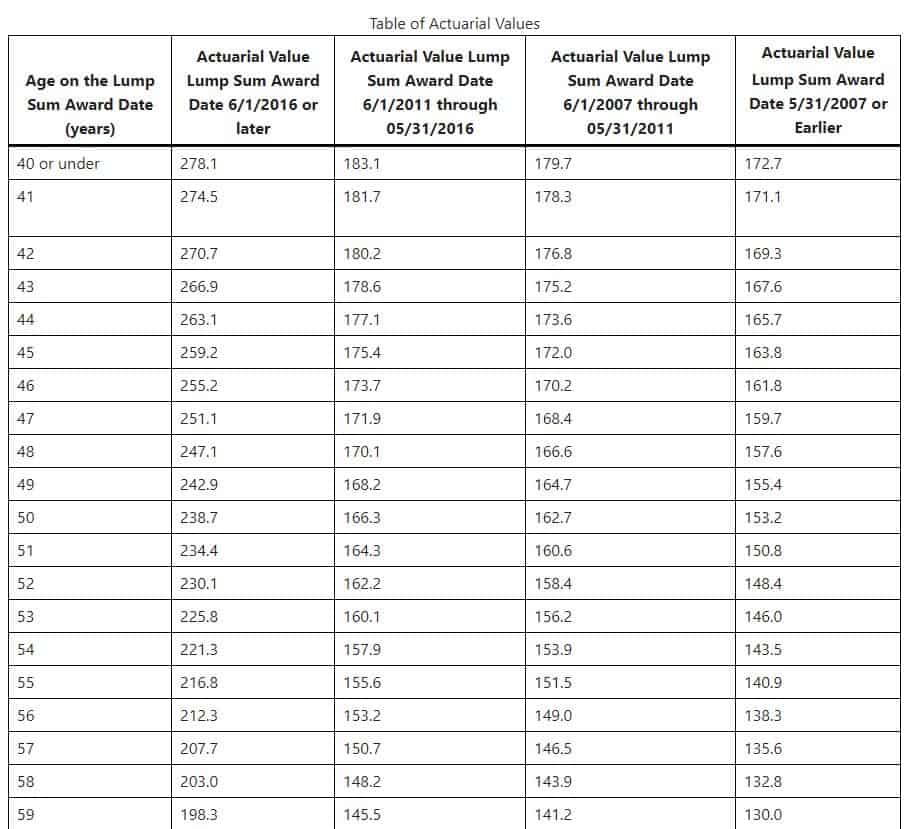

I estimate that youd be offered 470000 for a 3000 monthly pension that is about to start at age 65. Do Your Investments Align with Your Goals. Automated Investing With Tax-Smart Withdrawals.

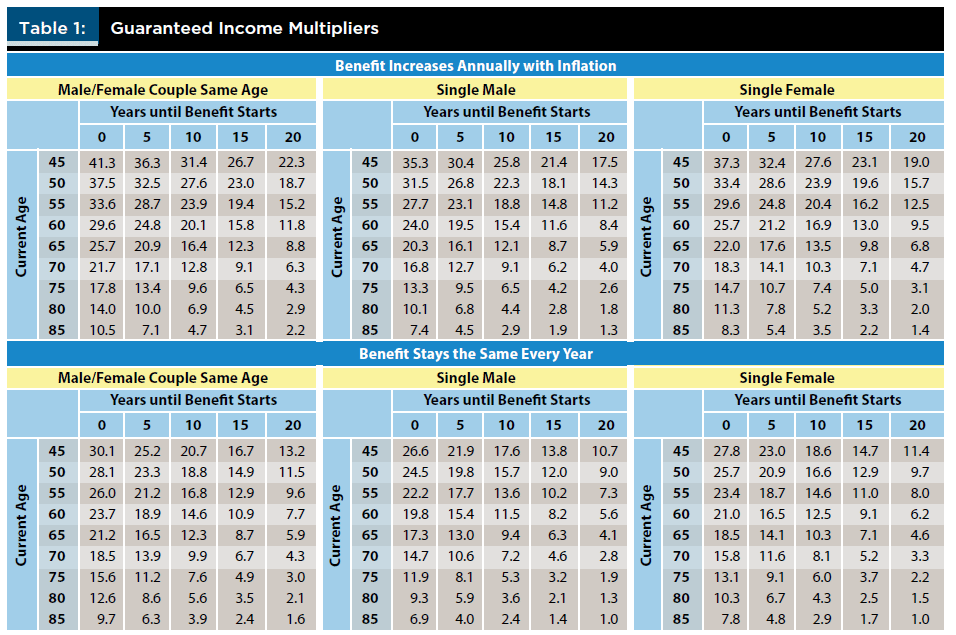

These require a lump sum to protect spouses if they outlive you. Ad From Life Retirement Planning To Investing Our Free Calculators Are Here To Help. To find out how this works in detail you can read our guide Should I take a lump sum from my pension.

The calculator discounts the. Ready To Turn Your Savings Into Income. The BRS Pension Lump Sum Calculator is an interactive calculator made available for informational purposes only.

This is a total lifetime limit even if lump sums are taken at different times. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Annuity payment calculator compares two payment options. Find out what the required annual rate of return required would be for. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

For every 1 of pension you give up you will get. How to Avoid Taxes on a Lump Sum Pension Payout. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Ad Understand How to Choose Between a Pension and Lump Sum Payout. A simplified illustration. Should you consider a lump sum pension withdrawal for your 500K portfolio.

Our lump sum vs. Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated.

Use the Lump Sum vs. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Using present value of an annuity table it is.

This could mean your pension lump sum would be higher than. Find out what the required annual rate of return required would be for. We have the SARS tax rates.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353. After collecting the lump sum you then get the standard pension.

Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. Find a Dedicated Financial Advisor Now.

Lumpsum Calculator

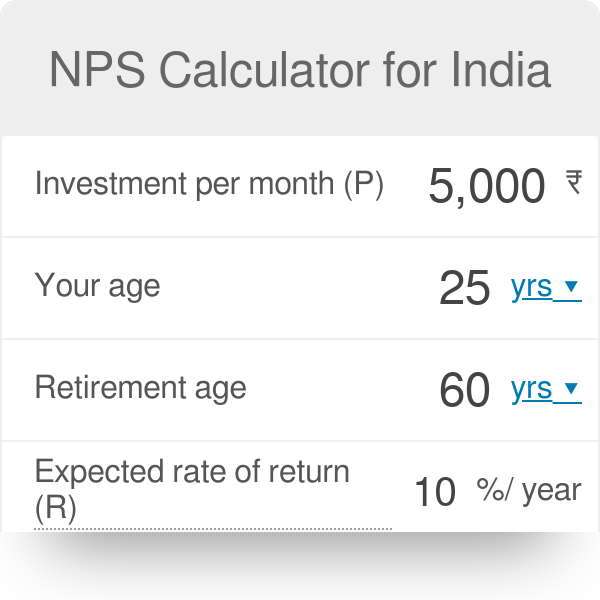

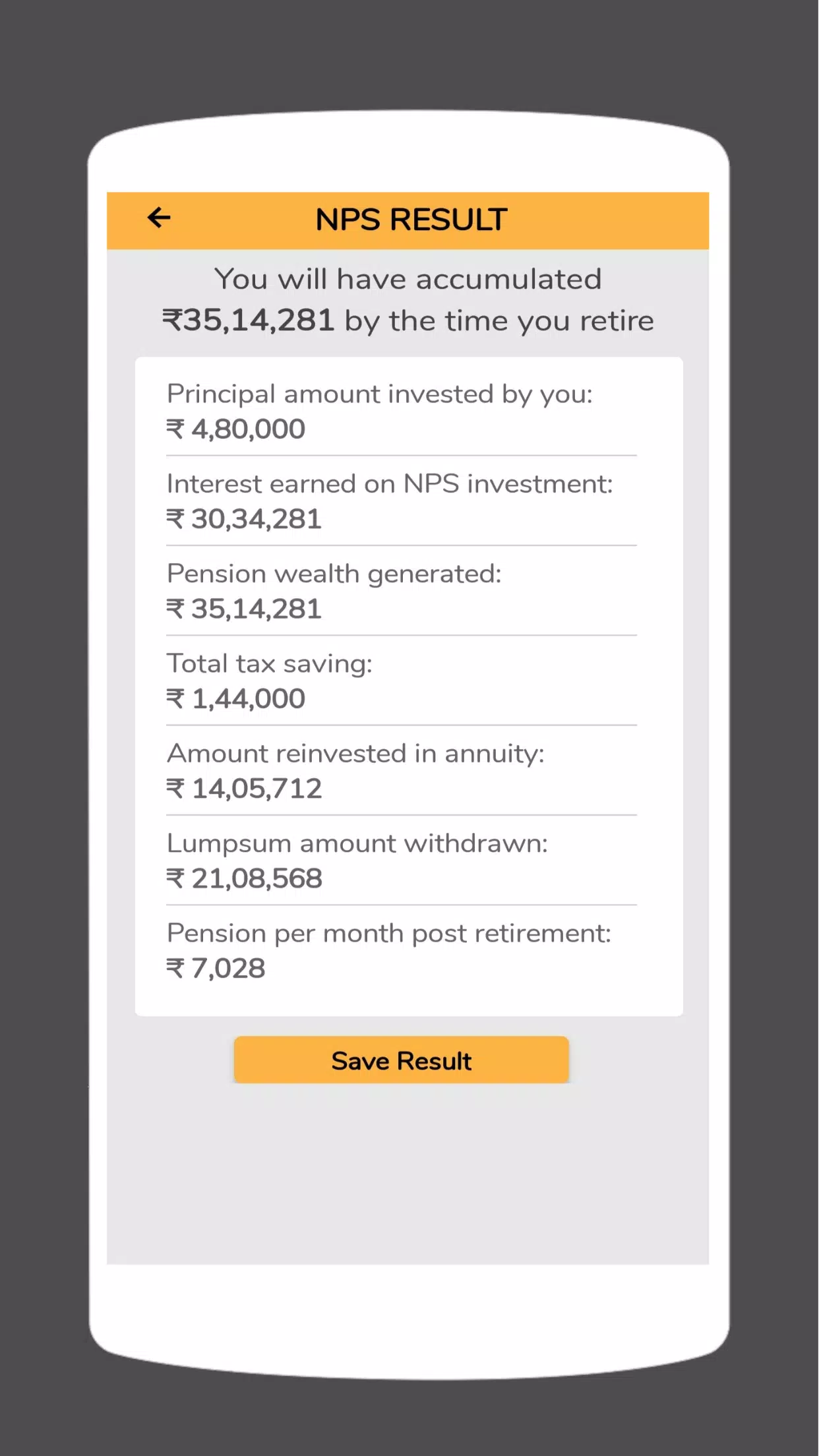

Nps Calculator National Pension System Nps Open Nps Account Online Sbi Pension Funds P Ltd

3 Ways To Compute Sss Retirement Benefits In The Philippines

.jpg)

Nps Calculator Calculate Pension Under National Pension Scheme

Learn How To Manage Your Pension How To Use Online Tools To Estimate It How To Calculate The Value Of A Lump Sum Finance Investing Pensions Annuity Calculator

Commutation Of Pension Calculator Central Government Employees News

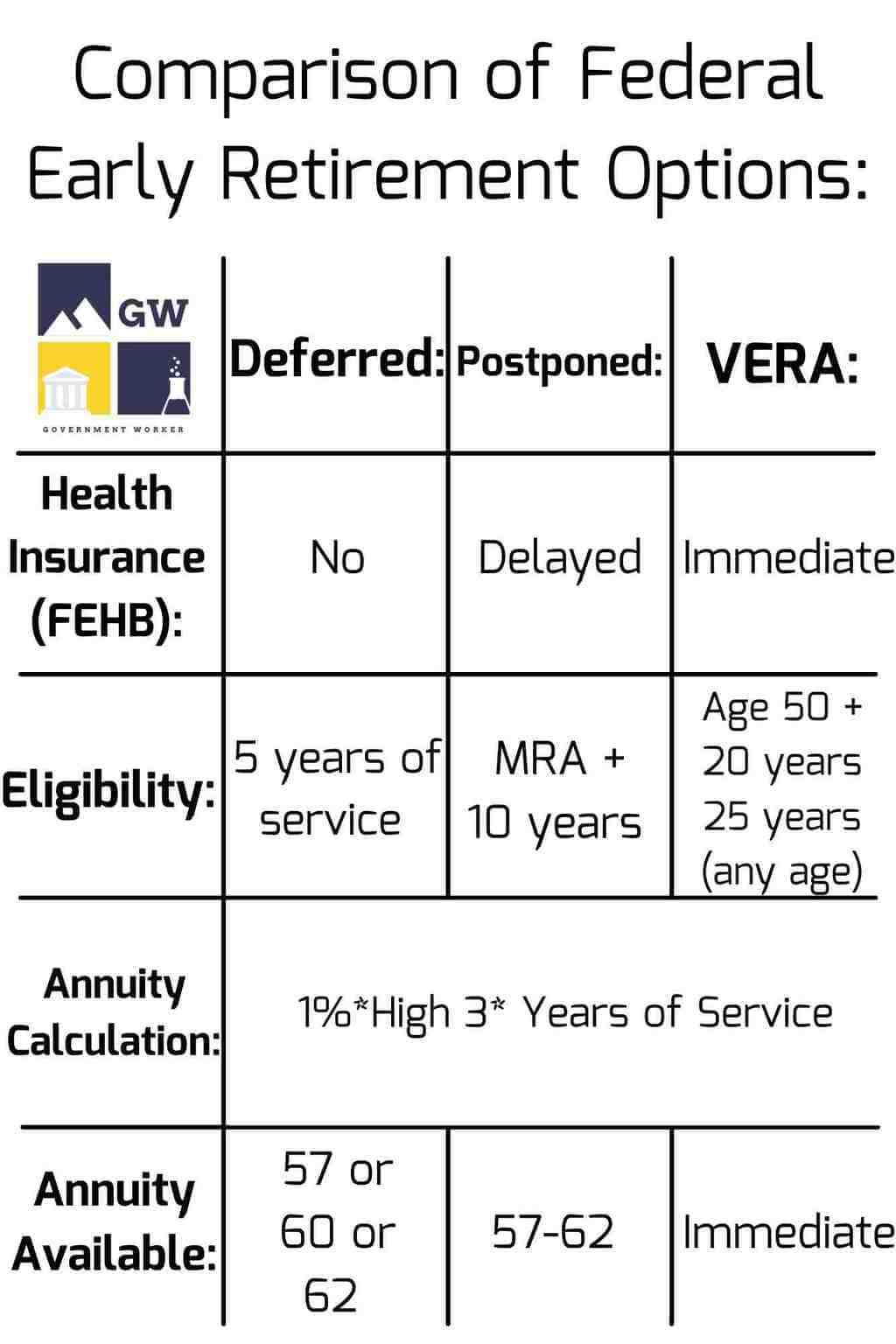

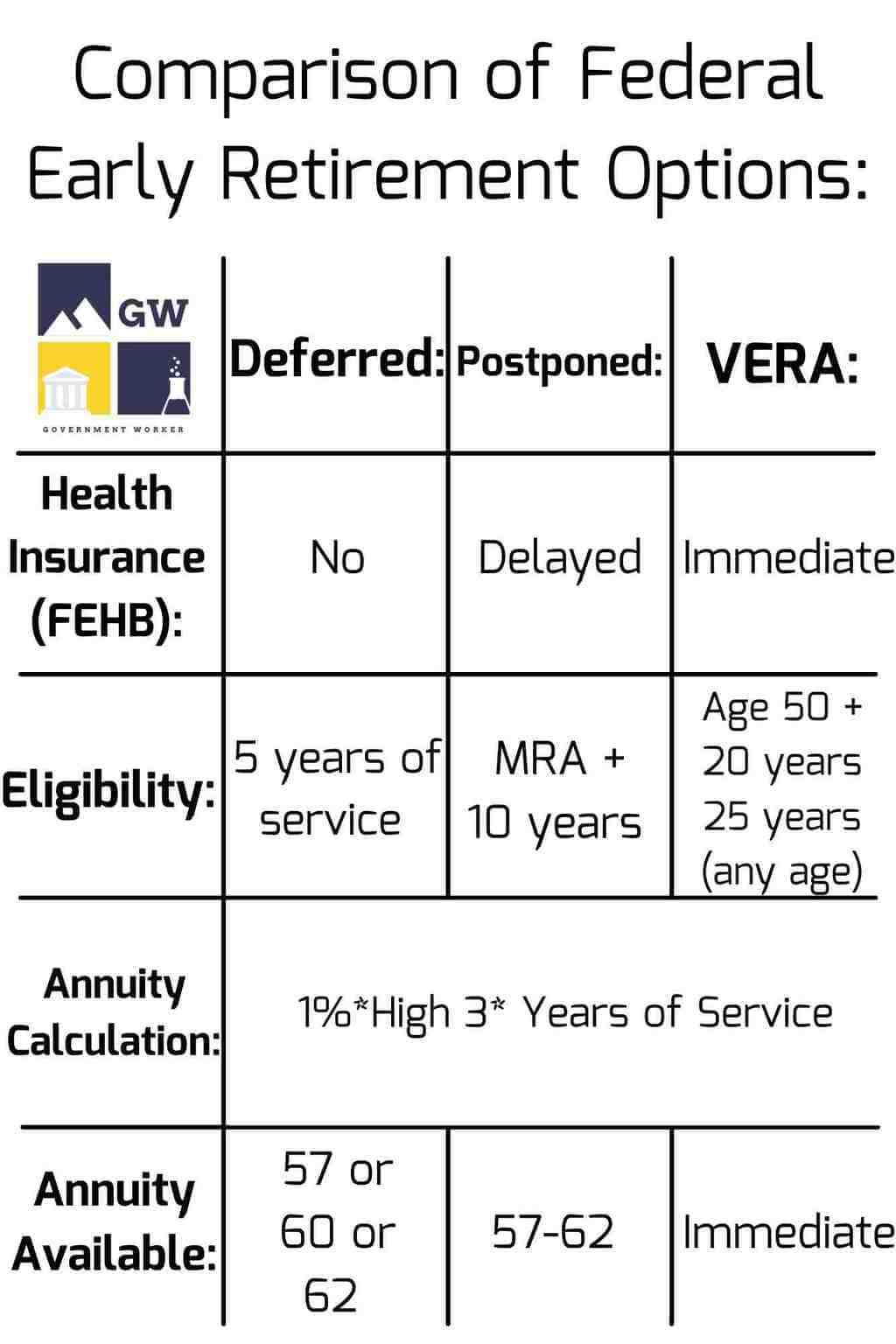

Federal Pension Calculator Government Deal Funding

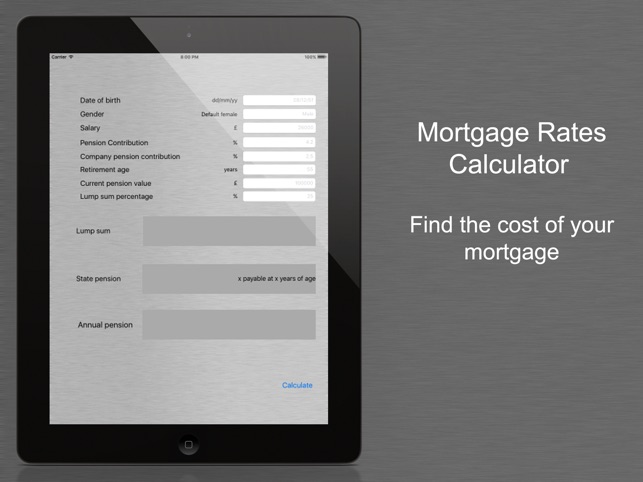

Pension Calculator Uk On The App Store

Pension Calculator Pensions Calculator Words Data Charts

Nps Calculator For India Pension Scheme

What Is A Pension Worth Andrew Marshall Financial Planning

Federal Pension Calculator Government Deal Funding

Pension Calculator Here Is How Your Retirement Money Is Fixed Zee Business

Nps Calculator Apk For Android Download

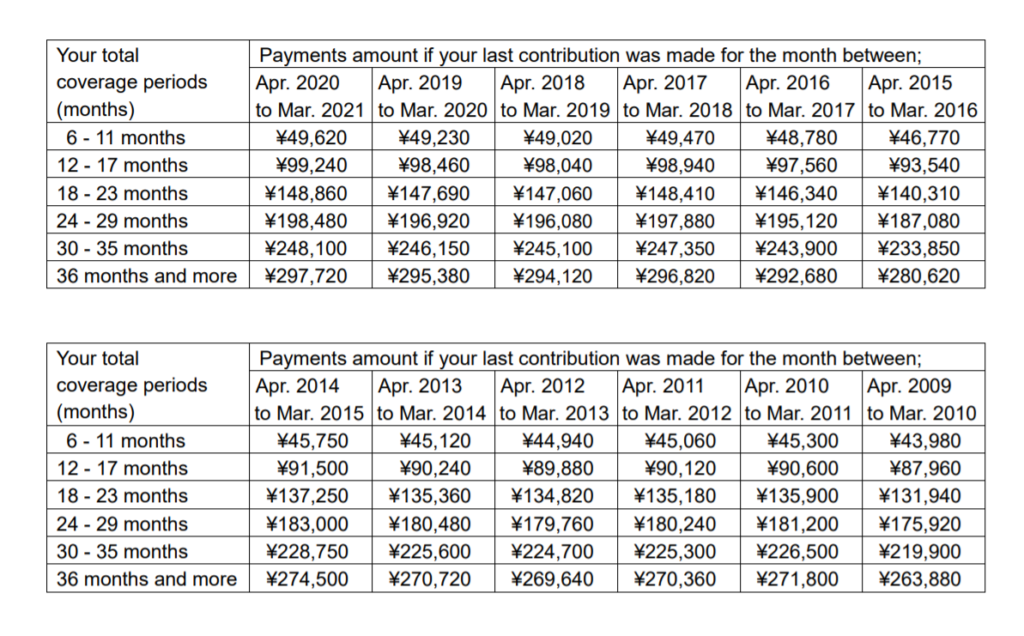

National Pension In Japan How To Claim The Lump Sum Payments Fair Work In Japan

Social Security And Lump Sum Pensions What Public Servants Should Know Social Security Intelligence

How To Calculate Your Pension Lumpsum Dịch Vụ Lấy Nenkin